Oh and apologies for the ironing board in one of the photos...the missus mustn’t have put it away

That should not be your wife's task @deej.

Sometimes people really disappoint me with their outdated, sexist stereotypes.

🙄

Doing the ironing, and tidying up afterwards, is a job for one of the maids.

Online guitar making courses – guitarmaking.co.uk

@russ and @tv101 I bought some paint from a company in France a few weeks ago and I thought I was going to be subject to tax as it entered the UK. I found this paint company online and it looked like a UK company, as it had a .co.uk domain and everything was written in English, it just had the feel of a UK company. So, I ordered and was then shocked a few days later when I got an email from a courier company, it was written in French. Ahhhhhhhh........ 😱

Anyway, a few days later the paint turned up and I didn’t have to pay any fees.

I had it out with the paint company, let’s just say they won’t be getting any more business from me.

I have been scared to order anything from Europe due to stupid political actors.

But, due to that shocking incident, I do feel a little more confident about buying stuff from the EU, so long as it’s under £130 or whatever the threshold is. The vendor adds the UK VAT on at the time of purchase apparently so long as it’s under that threshold, if it’s more than that, we pay it when it enters the country. I don’t think the item would cost any more, it may take a bit longer for delivery through because of customs. Who knows for sure. 🤷♂️

I think I might try ordering from Thomann again, it’s a great place.

Make guitars, not war 🌍✌️🎸

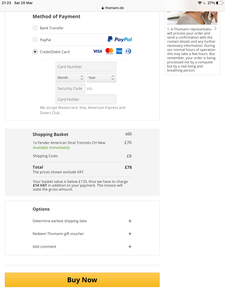

@russ Thomann have a note about a purchase when you get to checkout. The threshold is £135 and the price you see for the item you want is excluding UK VAT. The VAT and delivery cost gets added on at purchase. For example look at the picture below. This trem is £70 on the website but after VAT and delivery, it’s actually £92

Make guitars, not war 🌍✌️🎸

Currently, the process is in a state of "dis-equilibrium".

Or, chaos.

Although the rules are reasonably clear, there are options within the rules that make it less clear. Overseas sellers *can* register for a scheme whereby they pay the UK VAT in advance and remit directly to HMRC, but they don't have to. Then they have to fill in the forms correctly and attach the correct bits of the paperwork to their packages.

You then have to consider that UK customs are faced with a tsunami of parcels and packages (sent from the EU) that they previously didn't have to bother about, which they may now need to examine - individually - to assess whether VAT is due.

It's not unreasonable to assume that they won't (as yet) be looking at every single parcel. They just don't have the resources to do so.

Expect that you'll be charged per the rules. If not, you get an unenforceable-process bonus!

Online guitar making courses – guitarmaking.co.uk